Custodial Investment Accounts offer a powerful way to begin building wealth for minors. These accounts, often UTMA or UGMA accounts, provide a structured approach to saving and investing for a child’s future, but understanding the nuances of ownership, tax implications, and investment strategies is crucial for maximizing their benefits. This guide explores the various types of custodial accounts, the process of opening and managing them, and the key considerations for long-term financial success.

Custodial Investment Accounts offer a secure way for minors to manage assets, providing a pathway to financial independence. The unexpected resilience of a possum, as seen in this recent viral video, Possum Hanging By Tail , mirrors the long-term growth potential often associated with these accounts. Careful planning and consistent contributions to a Custodial Investment Account can similarly yield significant returns over time.

From selecting appropriate investments based on the beneficiary’s age to navigating the complexities of tax regulations like the “kiddie tax,” this comprehensive overview equips parents and guardians with the knowledge to make informed decisions and guide their child towards a secure financial future. We’ll delve into the step-by-step process of opening an account, funding options, and the importance of regular portfolio reviews to adapt to changing circumstances and financial goals.

Custodial Investment Accounts: A Comprehensive Guide

Custodial investment accounts offer a powerful tool for parents and guardians to begin building a financial future for their children. These accounts provide a structured way to save and invest funds for a minor, with various options available to suit different needs and risk tolerances. Understanding the different types, management strategies, and tax implications is crucial for maximizing the benefits of these accounts.

Definition and Types of Custodial Investment Accounts

A custodial investment account is a brokerage account opened and managed by an adult (the custodian) on behalf of a minor (the beneficiary). The custodian controls the account and makes investment decisions until the beneficiary reaches the legal age of majority, typically 18 or 21 depending on the state and the type of account. Two common types are Uniform Gift to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts.

UGMA accounts allow for gifts of cash and securities, while UTMA accounts offer greater flexibility, encompassing a broader range of assets including real estate and other types of property. The key difference lies in the types of assets that can be held and the age at which the beneficiary gains control. UGMA accounts typically transfer ownership to the beneficiary at the age of 18, while UTMA accounts allow for a later transfer, often at 21 or even older, depending on state laws.

The tax implications differ slightly. In both cases, the income generated within the account is taxed at the beneficiary’s tax rate, which can result in a higher tax burden than if the income were taxed at the custodian’s rate. However, the specific tax implications are influenced by factors like the beneficiary’s income and the “kiddie tax” rules (explained in detail later).

Choosing between UGMA and UTMA depends on individual circumstances and long-term financial goals for the beneficiary. For younger beneficiaries, a more conservative investment strategy might be preferable, while older beneficiaries could tolerate higher-risk investments.

| Feature | UGMA | UTMA |

|---|---|---|

| Ownership Transfer | Typically at age 18 | Typically at age 21 (varies by state) |

| Tax Liability | Taxed at beneficiary’s rate | Taxed at beneficiary’s rate |

| Contribution Limits | No limit | No limit |

Opening and Funding a Custodial Investment Account

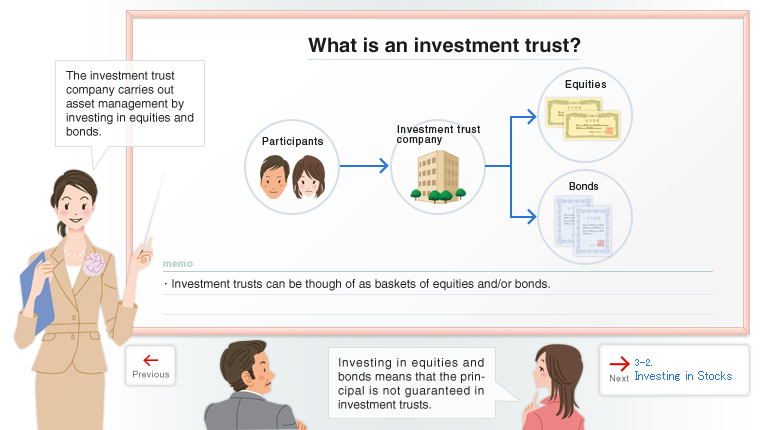

Source: co.jp

Opening a custodial account typically involves visiting a brokerage firm or bank offering such services. Required documentation usually includes the custodian’s and beneficiary’s Social Security numbers, proof of identity, and potentially proof of address. Funding can be done through various methods, including bank transfers, checks, and even cash (though this may be less common).

Fees and charges vary across institutions but typically include account maintenance fees, trading commissions, and potentially other transaction fees. It is crucial to compare the fee structures of different providers before choosing an account. Below is a step-by-step guide for funding a custodial account.

- Bank Transfer: Obtain the account routing and account numbers from the brokerage. Initiate a transfer from your bank account to the custodial account via online banking or by contacting your bank.

- Check: Make a check payable to the brokerage firm, specifying the custodial account number in the memo section. Mail the check to the address provided by the brokerage.

Investment Strategies for Custodial Accounts

Investment strategies should align with the beneficiary’s age and time horizon. For younger beneficiaries, a long-term, conservative approach is generally recommended, focusing on low-risk investments such as bonds and index funds. As the beneficiary gets older, the portfolio can gradually shift towards higher-growth, higher-risk investments like stocks. Diversification is key to mitigating risk and ensuring a balanced portfolio.

This involves spreading investments across different asset classes to reduce the impact of any single investment’s poor performance.

Potential risks include market fluctuations, inflation, and unexpected expenses. Mitigating these risks involves careful asset allocation, regular monitoring of the portfolio, and adjusting the strategy as needed based on market conditions and the beneficiary’s age. Parents and guardians can utilize various resources, such as financial advisors, educational websites, and investment books, to guide their investment decisions.

Tax Implications of Custodial Investment Accounts

Investment income earned within a custodial account is taxed at the beneficiary’s tax rate, not the custodian’s. This is crucial, especially considering the “kiddie tax” rules, which apply to children under a certain age who have unearned income exceeding a specific threshold. These rules dictate that a portion of the child’s unearned income is taxed at the parent’s higher tax rate.

Tax reporting for custodial accounts involves filing a tax return for the beneficiary, reporting the income earned during the tax year. The specific tax form required depends on the amount of income and other factors. Failure to report income accurately can result in penalties. The following table provides a simplified illustration of tax implications; consult a tax professional for personalized advice.

| Income Level | Account Type | Tax Implications (Simplified Example) |

|---|---|---|

| Low Income | UGMA/UTMA | Taxed at child’s rate, likely a low rate. |

| High Income | UGMA/UTMA | Subject to kiddie tax rules; portion taxed at parent’s rate. |

Managing and Transferring a Custodial Investment Account

The custodian is responsible for managing the account, making investment decisions, and ensuring compliance with tax regulations. Upon the beneficiary reaching the age of majority, the account’s ownership is transferred to them. This process typically involves completing the necessary paperwork with the brokerage firm. Potential issues during account management include market downturns, unexpected expenses, and disagreements between the custodian and beneficiary.

Adjusting the investment strategy as the beneficiary ages is crucial. A more conservative approach for younger beneficiaries should gradually transition to a more growth-oriented strategy as they approach adulthood. This involves shifting the asset allocation towards higher-growth investments while still maintaining a diversified portfolio.

Illustrative Examples of Custodial Investment Accounts

Example 1: Conservative Approach: A $10,000 initial investment for a 5-year-old in a mix of bonds and index funds, growing at an average annual rate of 5% over 13 years, would result in approximately $18,800 (excluding taxes and fees). The conservative nature of the investments mitigates risk but may result in slower growth compared to a more aggressive strategy.

Example 2: Growth-Oriented Approach: The same $10,000 initial investment in a more growth-oriented portfolio, including a higher allocation to stocks, might yield significantly higher returns but with increased risk. Over the same 13-year period, this portfolio could potentially grow to $25,000 or more, but it’s also more susceptible to market downturns.

A comparative analysis of these two examples highlights the trade-off between risk and reward. The conservative approach offers stability but slower growth, while the growth-oriented approach offers higher potential returns but with greater volatility.

Final Conclusion

Successfully navigating the world of custodial investment accounts requires a blend of financial understanding and strategic planning. By carefully considering the various account types, investment strategies, and tax implications, parents and guardians can create a solid foundation for their child’s financial well-being. Regular monitoring and adjustments to the investment strategy as the beneficiary matures are key to ensuring the account continues to serve its purpose effectively, ultimately leading to a more secure financial future for the child.