MyUHCMedicare/HWP balance: Understanding your account balance is crucial for managing your healthcare expenses. This guide navigates the complexities of accessing, interpreting, and reconciling your MyUHCMedicare account, providing a comprehensive overview of its various components, including claims processing, payment methods, and premium deductions. We’ll demystify the often-confusing world of healthcare billing, empowering you to take control of your finances.

From accessing your online balance to resolving discrepancies between online and paper statements, this guide offers step-by-step instructions and practical advice. We’ll explore the impact of submitted claims, the different payment options available, and how to understand premium deductions and co-pays. We also provide visual aids to better understand balance fluctuations over time.

Understanding Your MyUHCMedicare/HWP Account Balance

The MyUHCMedicare portal provides convenient online access to your Health Wellness Program (HWP) account balance. Understanding the components of this balance is crucial for effective healthcare cost management. This section details how to access, verify, and interpret your HWP balance information.

Accessing and Verifying Your Account Balance, Myuhcmedicare/hwp balance

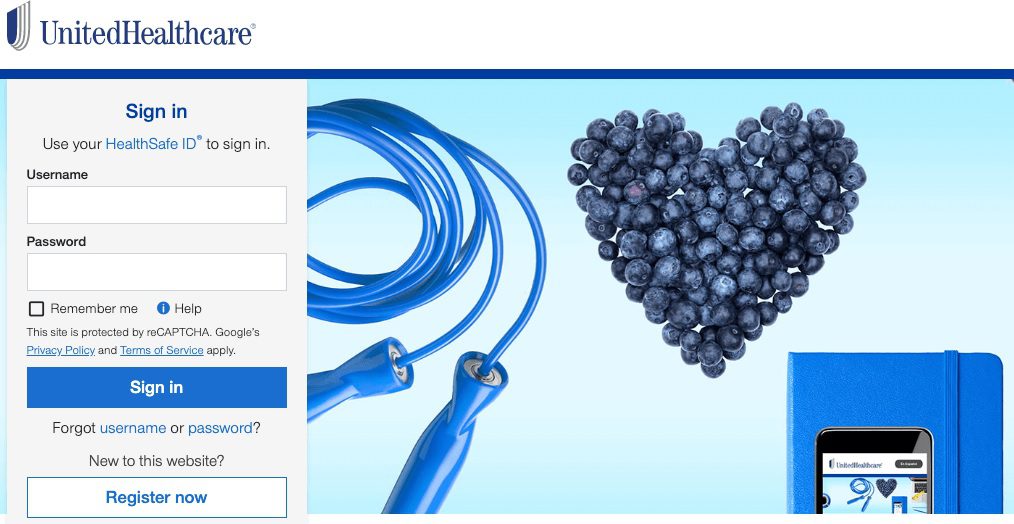

Accessing your HWP balance online is straightforward. First, log in to your MyUHCMedicare account using your username and password. Once logged in, navigate to the “Account Summary” or a similarly labeled section. Your HWP balance should be prominently displayed. Regularly checking your balance allows you to monitor your healthcare spending and identify any potential discrepancies.

Interpreting Your Account Balance Summary

The HWP balance summary typically includes several key components. Understanding each component is essential for accurate financial tracking. The following table breaks down the typical components you might see.

| Component | Description | Amount | Notes |

|---|---|---|---|

| Beginning Balance | Your account balance at the start of the billing cycle. | $XXX.XX | This will vary each billing cycle. |

| Premium Deductions | Amounts deducted from your account to cover your monthly health plan premiums. | -$XXX.XX | This amount is usually consistent unless your plan changes. |

| Claims Paid | Amounts paid by your insurance towards covered medical expenses. | -$XXX.XX | This amount fluctuates based on submitted claims. |

| Co-pays | Amounts you’ve paid directly for medical services. | -$XXX.XX | This depends on your plan’s co-pay structure and your utilization of services. |

| Other Deductions | Any other deductions, such as administrative fees (if applicable). | -$XXX.XX | This section will only show deductions if they exist. |

| Ending Balance | Your current account balance after all transactions. | $XXX.XX | This is the final balance for the billing cycle. |

Reconciling MyUHCMedicare/HWP Statements

Regularly comparing your online balance with paper statements helps ensure accuracy and identify any potential discrepancies. This section Artikels methods for reconciliation and steps to resolve any issues.

Methods for Comparing Online and Paper Statements

To reconcile your account, carefully compare the online balance with the balance shown on your paper statement. Pay close attention to each component listed (premiums, claims, co-pays, etc.). Match the dates of transactions and amounts to ensure consistency. Keep both your online records and paper statements for your records.

Potential Discrepancies and Their Causes

Discrepancies may arise due to processing delays, claim denials, or errors in data entry. Common causes include: delayed claim processing, claims submitted after the statement’s cutoff date, and errors in billing or payment processing. A thorough comparison will help identify the root cause.

Resolving Balance Discrepancies

If discrepancies exist, contact MyUHCMedicare customer support immediately. Provide them with both your online and paper statement details, clearly outlining the differences. They can investigate the issue and provide a resolution.

- Note down the specific discrepancies between the online and paper statements.

- Gather all relevant documentation, including claim details and payment confirmations.

- Contact MyUHCMedicare customer support via phone or online chat.

- Clearly explain the discrepancies and provide the necessary documentation.

- Follow up on the resolution and keep records of all communication.

Impact of Claims on MyUHCMedicare/HWP Balance

Submitted claims directly influence your HWP balance. This section explains how claim status affects your balance and the typical processing timeframe.

How Claims Affect Your Balance

When you submit a claim, the balance will typically reflect a pending deduction until the claim is processed. Once processed and approved, the amount will be deducted from your balance, reducing the amount you owe. If a claim is denied, your balance will not change, and you may be responsible for the full cost.

Claim Processing Timeframe

The typical timeframe for claim processing varies depending on the complexity of the claim and the supporting documentation. It usually takes several business days to a few weeks. You can check the claim status online to track its progress.

Implications of Denied or Partially Paid Claims

Source: seminarsonly.com

Understanding your myuhcmedicare/hwp balance requires careful review of your statements. However, unrelated online searches, such as those related to the potentially misleading term craigslust ny , should be avoided as they are irrelevant to your healthcare finances. Returning to your myuhcmedicare/hwp balance, remember to contact customer service if you have discrepancies.

Denied claims mean your insurance didn’t cover the expenses. Partially paid claims mean only a portion was covered. In both cases, you’ll be responsible for the remaining amount, and your balance will reflect this. Review your Explanation of Benefits (EOB) to understand why a claim was denied or partially paid.

Examples of Claim Status Impact

Example 1: A pending claim of $500 will show a pending deduction of $

500. Example 2: A processed claim of $500 will show a $500 deduction. Example 3: A denied claim of $500 will not change your balance, and you remain responsible for the full amount.

Managing MyUHCMedicare/HWP Payments

Several methods are available for making payments to your HWP account. This section details the available payment options and how to manage your payment history.

Available Payment Methods

Common payment methods include online payments, mail-in checks, and potentially phone payments. Each method has advantages and disadvantages.

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Online Payment | Convenient, fast, and provides immediate confirmation. | Requires internet access. |

| Mail-in Check | No internet access required. | Slower processing time, and risk of lost mail. |

| Phone Payment (if available) | Convenient for those without online access. | May have longer hold times. |

Making Online Payments and Setting Up Automatic Payments

To make an online payment, log into your MyUHCMedicare account and navigate to the payment section. Follow the on-screen instructions to submit your payment. Automatic payments can often be set up through the same section, allowing for recurring payments.

Viewing Payment History and Downloading Payment Confirmations

Your payment history is typically accessible within your account summary. You can usually download payment confirmations as proof of payment.

Understanding Premium Deductions and Co-pays: Myuhcmedicare/hwp Balance

Premium deductions and co-pays are essential components of your HWP balance. This section explains how they are reflected in your balance.

Premium Deductions

Premium deductions are automatically deducted from your HWP balance each month to cover your health plan’s premium cost. The amount deducted is consistent unless your plan changes.

Calculating Co-pays

Source: manometcurrent.com

Co-pays are amounts you pay directly for medical services at the time of service. The amount varies based on your plan and the type of service. These amounts are then deducted from your HWP balance.

Examples of Co-pay Scenarios

Example 1: A doctor’s visit with a $30 co-pay will deduct $30 from your balance. Example 2: A specialist visit with a $50 co-pay will deduct $50 from your balance. Example 3: A prescription with a $10 co-pay will deduct $10 from your balance.

Flowchart: Service to Co-pay Deduction to Balance Update

The process typically follows these steps: 1. Service Received; 2. Co-pay Paid; 3. Co-pay Deduction Recorded; 4. Balance Updated to Reflect Deduction.

Visual Representation of Balance Changes

The MyUHCMedicare portal may utilize visual aids like graphs or charts to represent balance changes over time. This section describes how to interpret such visual representations.

Typical Visual Representations

A common visual representation might be a line graph showing your balance over several months. The x-axis represents the time period (e.g., months), and the y-axis represents your account balance. The line itself traces the fluctuations in your balance over time.

Information Conveyed Through Visual Representations

These visuals offer a quick overview of your spending patterns and balance fluctuations. You can easily identify periods of high medical expenses or significant balance changes.

Detailed Description of a Sample Graph

Imagine a line graph. The x-axis shows months (January, February, March, etc.). The y-axis shows the balance amount (in dollars). The line starts at a certain balance in January, dips down in February (due to a large claim payment), rises slightly in March (due to a smaller co-pay), and continues to fluctuate, showing the overall trend of your balance throughout the year.

Conclusive Thoughts

Mastering your MyUHCMedicare/HWP balance empowers you to proactively manage your healthcare costs. By understanding the intricacies of your account, you can identify and resolve discrepancies promptly, ensure timely payments, and maintain a clear picture of your financial responsibilities. This guide serves as a valuable resource for navigating the complexities of healthcare billing and ultimately, taking control of your healthcare finances.